EXCLUSIVE: Cheech & Chong’s Cannabis Co. Plans 100 Branded Stores in 18 Months: ‘We Don’t Need To Be an MSO

When I spoke with Cheech & Chong’s team in 2025, the tone leaned more toward business planning than cultural throwback, which makes sense at this stage of the industry.

But there’s still room for a cultural fight. On one side: a retail landscape dominated by multistate operators (MSOs) that carve out protected territories and lean on regulatory power instead of brand building. On the other side: a legacy cannabis brand trying to stitch together a national network of independent dispensaries without becoming the thing they’re critiquing.

The weapon, they insist, is IP licensing, not empire-building.

“We’ve got a handful of MSOs that raised a huge amount of money and they’ve kind of been able to wall off the states they operate in. It’s pretty protectionist,” says president Brandon Harshbarger. “The model we’re giving to smaller independent operators is a way to take an iconic brand and lay it across their store… and compete on something other than just license power.”

Instead of buying stores, Cheech & Chong’s Cannabis Company is selling an overlay:

branding, design, data, marketing, and a bit of cultural gravity.

Retailers keep ownership. C&C takes a 6% royalty and tries to drive a 20–30% lift at the register.

“We don’t need to become an MSO,” says CEO Jonathan Black. “The OPEX to become an MSO and the state lines doesn’t fit the goals of this company. When we started, the goal was to get products with consumer confidence into every consumer’s hands, no matter where they are. Hemp gave us the bridge; retail completes it.”

They tested the concept quietly in Massachusetts a year and a half ago, with three locations in non-glamorous markets and a parallel launch of their hemp drinks. The numbers were good enough to scale. Today the company counts 8 stores in Montana, 1 in Oklahoma, 3 in Massachusetts, 3 in Maine and 1 in Guam.

Brands vs. Muscle

I asked Harshbarger what’s actually working in cannabis right now:

“Brands are working,” he says. “There are only a handful of real brands you see operating coast to coast. I think we’re one of them. Cookies, Stiiizy—brands that are in merch, in hemp-derived products, in beverages, in retail, and in the traditional dispensary market.”

What’s not working, in his view, are the companies that bet everything on regulatory leverage and local political influence.

“Some of the more traditional MSOs focused more on the regulatory localized power they have and not necessarily on building a brand. Over time, that’s going to defeat them. Schedule III will occur, limitations will fall away, and this becomes a coast-to-coast business. If you don’t have a recognizable brand, you’re going to have a difficult time evolving in cannabis.”

C&C is betting that when the walls come down, brands plus community-rooted independents will be more adaptable than giant, rigid structures.

The Hemp Ban and the Illicit Market

Black and Harshbarger have recently been in D.C. They met with Senator Rand Paul in Kentucky. They’ve talked to House members. They think the Hemp Ban idea is a policy mistake with classic prohibitionist fingerprints.

“I do think it is absolutely a mistake,” Black says. “You’re talking about, depending on the source, a $70–90 billion impact for hemp. Hemp has been a way to meet traditional consumers where they are—at mass retailers like Total Wine, ABC, Circle K, Target.”

Someone who will never set foot in a dispensary might try a 5–10 mg hemp beverage in a familiar grocery or bottle-shop setting. That becomes either an alternative to alcohol or a first step into the broader cannabis ecosystem.

They argue that killing the path won’t make people safer. You just lose visibility and ID checks.

“A ban works like this,” Black says. “When you ban something, what you’re doing is shoving it over to the illicit market. And I’ll tell you what drug dealers don’t do.”

A Network Instead of an Empire

Under all the branding language, C&C offers:

A 6% royalty based on sales

A store redesign and brand guide tailored to each space

Access to Headset data, live menus and performance analytics

National marketing that funnels hemp and DTC customers into partner dispensaries

A long-term exit strategy tied to revenue performance

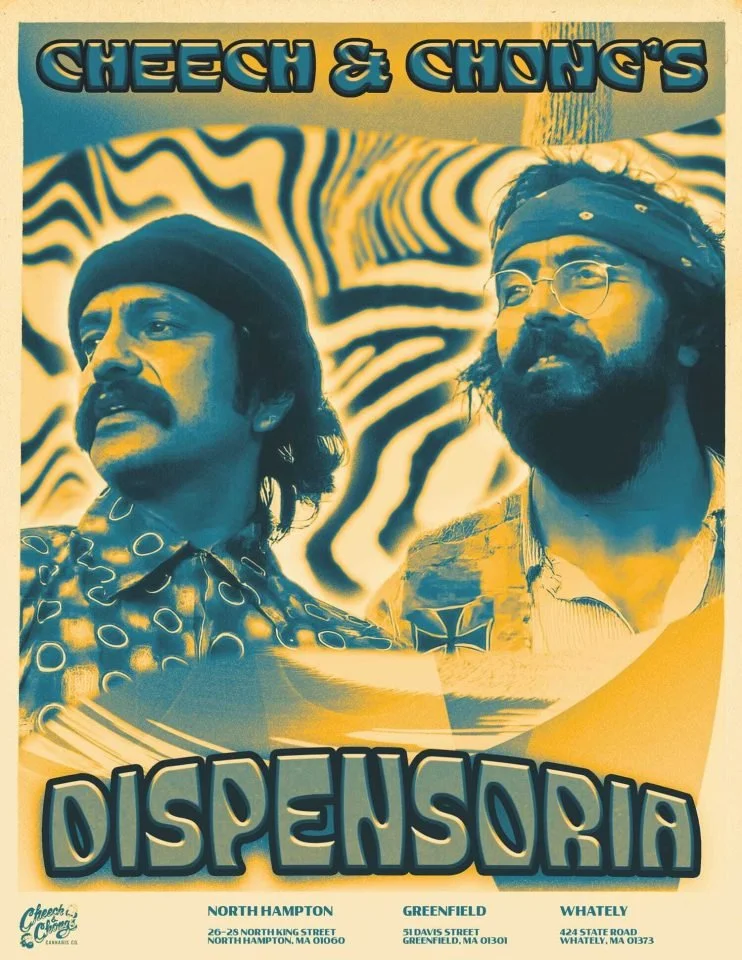

The company offers two paths for retailers: Cheech & Chong’s Dispensoria, which is a full-store rebrand; and Flowered by Cheech & Chong, which works as a co-branded shop-in-shop for operators who want to keep their existing identity.

In return, they get coast-to-coast presence without owning licenses or going vertical.

“MSOs might say they’re ‘just cannabis,’” Black adds, “but they sell hemp products like we do. They sell drinks like we do. We just built around brand power and smart partners instead of building infrastructure and then trying to buy culture later.”

For now, Cheech & Chong’s team is betting that in a market squeezed by policy, capital and consolidation, there’s still room for a network based on good popular brand work.